Nov 7, 2017 · 8 min read

Bitcoin’s Substantive & Technical Road to $100K

Kerati Apilakvanichakit

Kerati Apilakvanichakit

Bitcoin is a speculative asset that has successfully passed its experimental phase and is now unstoppable.

The study of Bitcoin is one of the most exciting and innovative fields today, where its security model is an intriguing cross-disciplinary study that includes computer programming, game theory, mathematics, physics & energy among others. Connecting peer-to-peer without a third party certainly reduces costs, and money is only the first application. Increasing the efficiency of land registries and instantaneously pulling a valid preliminary title report will be thrilling. When you centralize sensitive information, you get the Equifax hack of 143 million Social Security numbers. When you decentralize the storage of sensitive information, you specifically negate the single point of failure. Centralization of information, centralization of money, and centralization of power is no bueno. A potentially new asset class has emerged as a byproduct of code and disintermediating the need for third parties. A paradigm shift is underway, Bitcoin and Cryptocurrencies are here to stay. The sooner you realize this, the sooner you will come to grips with what’s to come. Explaining Bitcoin is like describing to someone living in the early-1900s how the internet works and why people take pictures of nearly every meal.

To understand how Bitcoin works, we must first examine how BTC mining transpires as it is an implementation of the protocol’s security model and consensus-algorithm. Substantial changes to a revolutionary technology with no one in absolute control requires consensus among developers, users, miners, exchanges and merchant services. As with all segments of society, each group within this Bitcoin community have different intentions. Some objectives aligned and others did not. A twenty-four month ideological divide within the community concluded with the administration of Segregated Witness (SegWit) to the Bitcoin protocol. The brilliance in Satoshi Nakamoto’s vision of no one controlling Bitcoin was superbly demonstrated by the process of upgrading to SegWit. Bitcoin’s consensus-algorithm is working, and it is working quite nicely.

GENESIS BLOCK: THE TIMES 03/JAN/2009 CHANCELLOR ON BRINK OF SECOND BAILOUT FOR BANKS

The Bitcoin blockchain has been beating like a heart every ten minutes since London’s leading national newspaper published their bailout headline. On the same day, Miss, Mister, or a group of Nakamotos forged the Bitcoin genesis block with the same message.

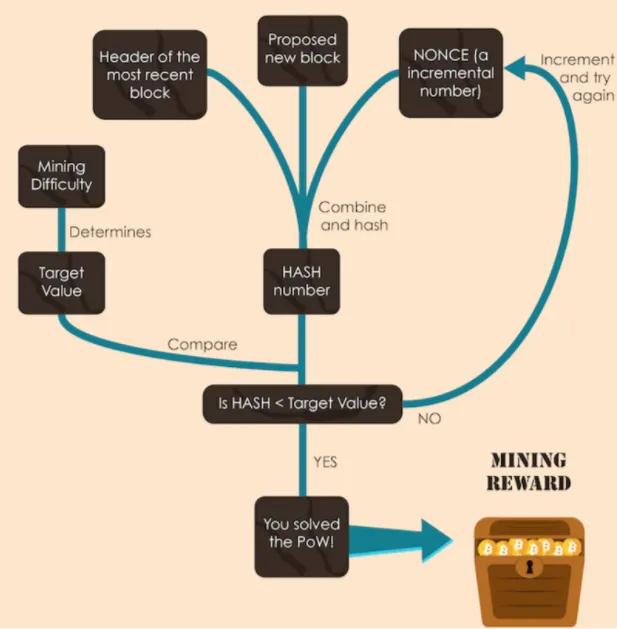

Satoshi created a token in which people compete to earn a block reward that is BTC. The structure of the game automatically adjusts difficulty when more or less people play — the more players play, the harder the game. The game lasts for approximately ten minutes in which a winner is declared and the reward is delivered. To become a winner, participants must solve a highly-complex mathematical problem by hashing their computing power. Miners with more processing power have a greater likelihood of earning the block reward (and transaction fees). Players, participants, or miners hash while concurrently taking transactions in an unconfirmed pool and placing them in a block. Transactions that have higher fees get chosen before lower ones. When a participant solves the puzzle first, their Proof-of-Work (PoW) gets shared immediately on the public blockchain with and for the other miners to verify that it is in fact, confirmed. Upon successful PoW verification by the other miners, the block reward and transaction fees are delivered to the winner. Losing miners rage and throw away their work during which all miners link the new valid block to the existing chain by updating their own ledger, the game then restarts. Proof-of-Work is a free market-based design where miners play a crucial role in verifying transactions and upholding the immutable blockchain, a direct result of their profit-seeking behavior. Satoshi Nakamoto elegantly weaves these facets together by deliberately incentivizing miners to compete in a game and earn a monetary reward in exchange for their work in securing the Bitcoin blockchain.

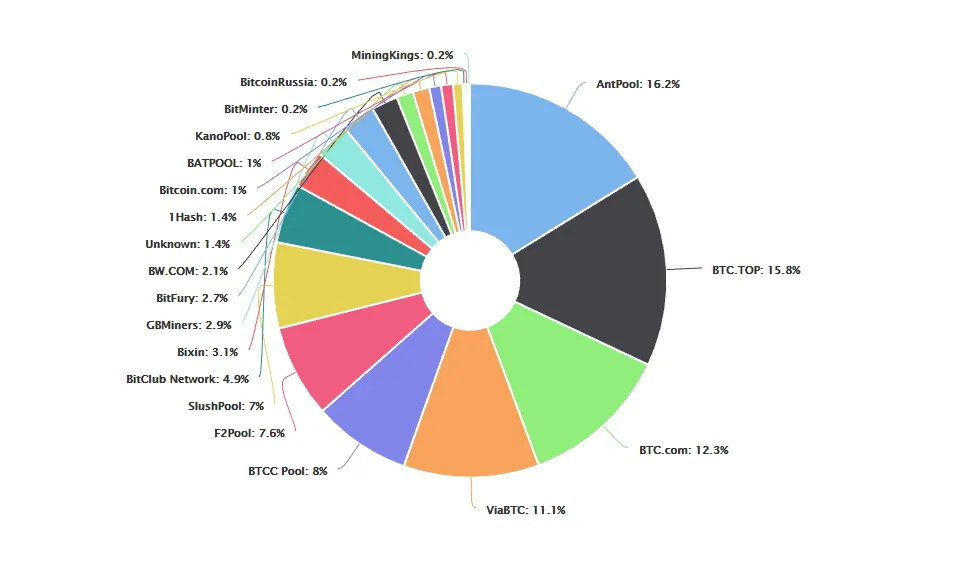

Bitcoin’s security model is a carefully formulated system that exploits human nature’s greed and produces a security mechanism out of it. In order to be profitable, Bitcoin miners must 1) have enough processing power to enter the race and 2) earn enough rewards to pay the electricity bills. With enough computing power, a dishonest group of miners can overtake the network by colluding to control 51% of the global mining capabilities. Attacks can range from reverting old transactions to targeting which transactions to confirm and which to not send-through. Such miners face a financial dilemma to either attack the network and earn BTCs dishonestly, or to perform PoW and earn BTCs truthfully. It costs nearly two million dollars to sustain a 51% attack for one day, while the market share and profitability doubles for the other 49%. All it takes to dismantle the colluding group is for 2% to renege. The opportunity cost is too great as it becomes increasingly unsustainable and unprofitable to not play by the rules. When faced with the Miner’s Dilemma, potentially malicious miners quickly figure out that they are economically better off playing Satoshi’s incentivized-game, committing their hashing power to secure the network, and earning BTCs the honest way. Rational miners that are financially-motivated is precisely the reason why such attacks have not surfaced since Bitcoin’s inception. This is the beauty of Bitcoin’s game theory.

Bitcoin has no President, no CEO, no entity for the SEC to fine, no one to bring in front of Congress, no central server to hack, nor any single point of failure. Let us now discuss a scenario of a well-orchestrated and irrational government attack on Bitcoin. It is physically impossible to synchronize a real assault on all Bitcoin devices. A physical attack on Bitcoin would involve destroying all functioning mining machinery and user nodes spread across the globe at the same time, including a satellite in space. A virtual attack would take a inconceivable multinational effort and cost over $30 Billion of startup capital. The original blockchain network has an unbelievably immense amount of global computing power behind it, more than all Google servers and more than the world’s Top 500 Supercomputers combined by a very long mile. Total mining energy consumption is equal to one-third of San Jose’s household electricity needs on a daily basis. This is the skin in the game and value responsible for the most 100% decentralized and computationally-secure network on Earth. We now assume that governments have unlimited resources because well, they can print unlimited amounts of money after all. Given an attack on the entirety of Bitcoin also assumes that the five consensus-constituents join forces: developers, users, miners, exchanges, and merchant services. A conglomerate of governments attacking the Bitcoin network would only last ten minutes before the virtual assault gets rekt. For scenario sake, the same bad actors could have easily instead utilized their resources to earn BTCs and pay off their debt. Bitcoin has become a fantastic culmination of cryptography, game theory, cyber security, software and network architecture. Bitcoin does not have enterprise-grade security, Bitcoin has world-class and planetary-grade security.

THE DIGITAL & DECENTRALIZED ERA

The more companies and nation-states participate in the mining game, the more powerful and decentralized Bitcoin becomes. Recently, a Japanese company aims to develop new Bitcoin hardware chips and mining facilities. Russian President Vladimir Putin and his administration is looking to invest $100 Million into Bitcoin mining and North Korea is what? The next-generation arms race will be in artificial intelligence and Bitcoin dominance. Satoshi Nakamoto’s genius design of Bitcoin’s trustless nature further demands respect as a work of art. Miners do not trust each other because they are competing amongst one another — they are obligated to not trust, but verify. Users do not need to trust other users because they can both own carbon copies of the ledger and use it to verify as needed. Given a natural state, users and miners definitely do not trust each other. The Bitcoin blockchain is a collaboration of capital-intensive miners and speculative users, all of whom have no need to trust one another in order for the decentralized system to work. People with trust issues should appreciate this aspect.

The most decentralized form of money has established itself as an excellent performer in the face of political turmoil and economic instability. Bitcoin does what gold can do and does it a thousand times better without any manipulation. When you combine everything and add Bitcoin’s simulation of digital scarcity as the cream on top, it creates for a phenomenal new asset that many people dismiss because they underestimate, or simply do not understand. A tremendous amount of money is about to enter Bitcoin’s puny $100 Billion market cap. Institutional investors such as hedge funds, insurance companies, mutual funds, Wall Street and retail investors are near. LedgerX came online in October as the first US-regulated options market for Bitcoin. Chicago Mercantile Exchange (CME) plans to launch the first US-regulated Bitcoin futures market by year-end. An Exchange-Traded Fund (ETF) will be the next step thereafter. Once Bitcoin receives government stamps of approval, mass adoption will be the final step.

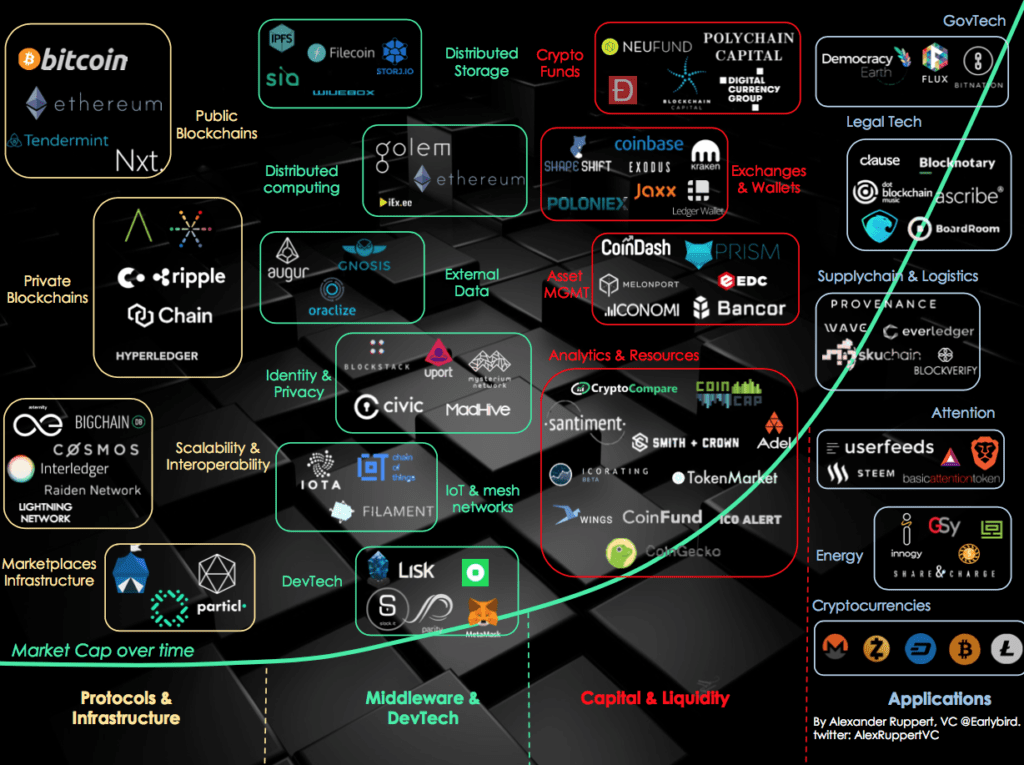

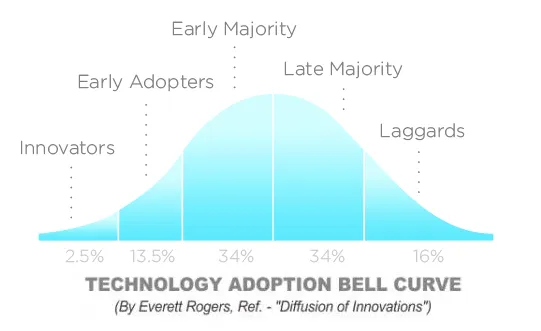

I find it difficult, yet quite important to elaborate on the intricacies of decentralization and why it matters. The idea of blockchain is not really new, it is merely a digital ledger or database. The key is decentralized with no one in complete control and no central point of failure, truly groundbreaking features. According to Everett Rogers’ famous study, “not everyone will immediately adopt a disruptive idea despite obvious benefits”. People, you and I, are naturally resistant to change. It happened with gas to electricity in the late-1800s, it happened with horses to automobiles in the early-1900s, it happened with the printing press to the internet in the late-1900s, and it is happening with centralized to decentralized during our time. I believe we are in the middle of the Early Adopters phase and because we already have the internet, Bitcoin’s adoption will happen more swiftly. The speed of information is faster than the speed of light. Bitcoin is the premier digital asset that redefines trust, morphing networks into financial tokens of value and utility, in a decentralized manner. This is the internet boom and bust 2.0, but we are nowhere near the magnitude of the dotcom bubble until mass adoption ensues. In this realm, Initial Public Offerings (IPOs) are Initial Coin Offerings (ICOs) and scams are as rife as innovation. Nonetheless, there are many great ideas with good intentions. A peer-to-peer energy sharing economy, 100% transparent online casinos & prediction markets, dismissal of voter fraud through blockchain, and distributed cloud-computing. To make more efficient and secure by eliminating the need for trust in a third party, what can you decentralize? That, is the million Bitcoin question.